Contents

Issue 23

Contents

By The Moralis Research Team

Welcome back, everybody. It’s been another exciting week in crypto, and we’re pleased to bring you the next edition of Moralis Research. Today, we will be interested in getting your feedback on the content of these reports. Please take a few minutes to give us your feedback here. We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report, please remember to fill out the feedback form,

your feedback is valued, and we’re always open to suggestions.

By CTO Larsson

February 24th, 2023 | 09:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend is up

Consolidating below resistance

Trend is down

Trend is down

Trend is up

Ranging

Very close to range breakout!

Hesitating

Trend is up

Trend is up

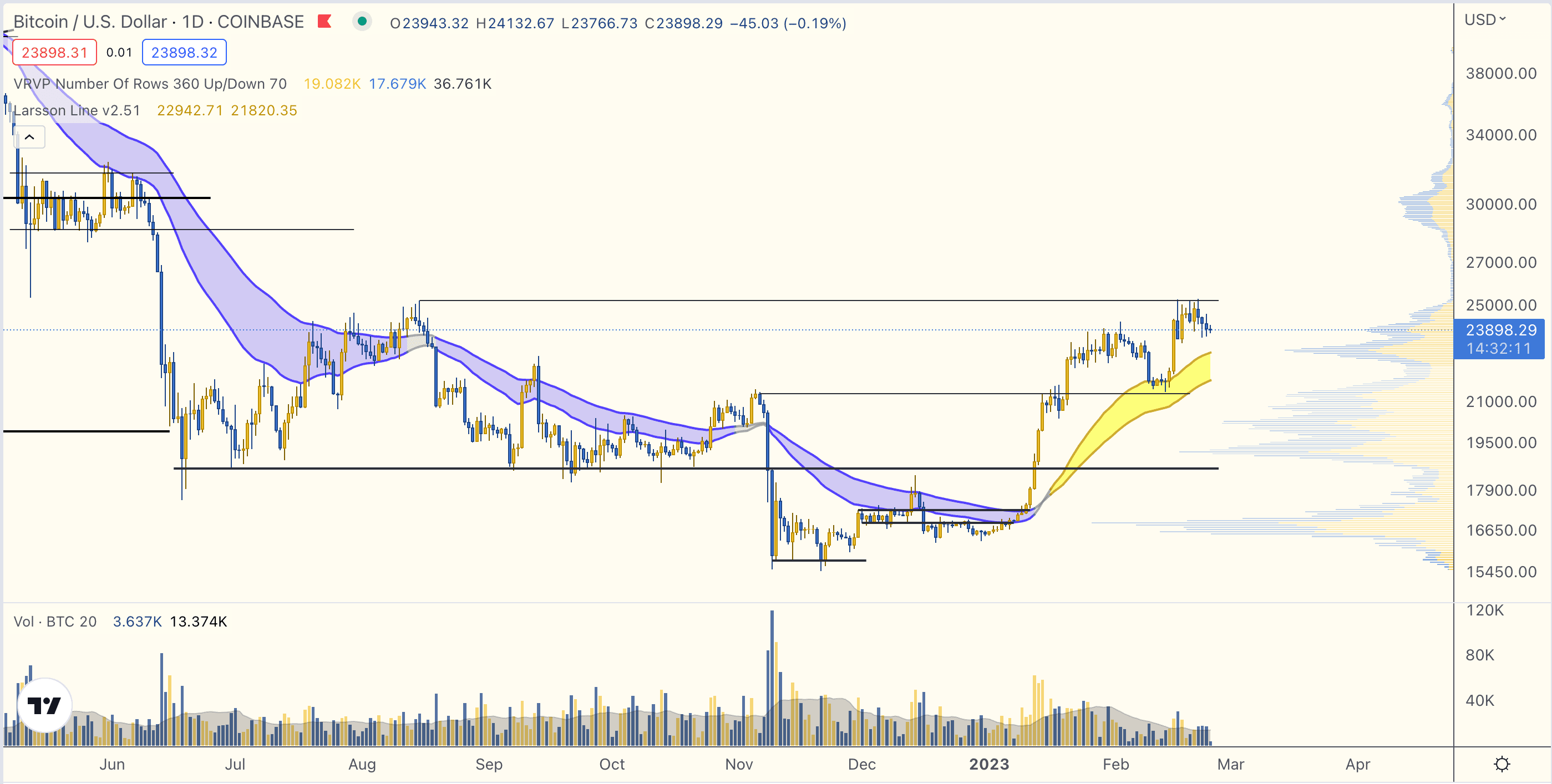

Bitcoin

Trend up, rejected at first resistance

The picture is clear: Bitcoin got a rejection at the first real resistance 25k.

With the trend up, I’m hoping for another opportunity to buy at support.

If that doesn’t happen, I’m hoping for a controlled entry after breakout and retest.

If the situation changes, I’ll change my mind.

It’s really that simple. Beyond that, there is little point in speculating on future events right now.

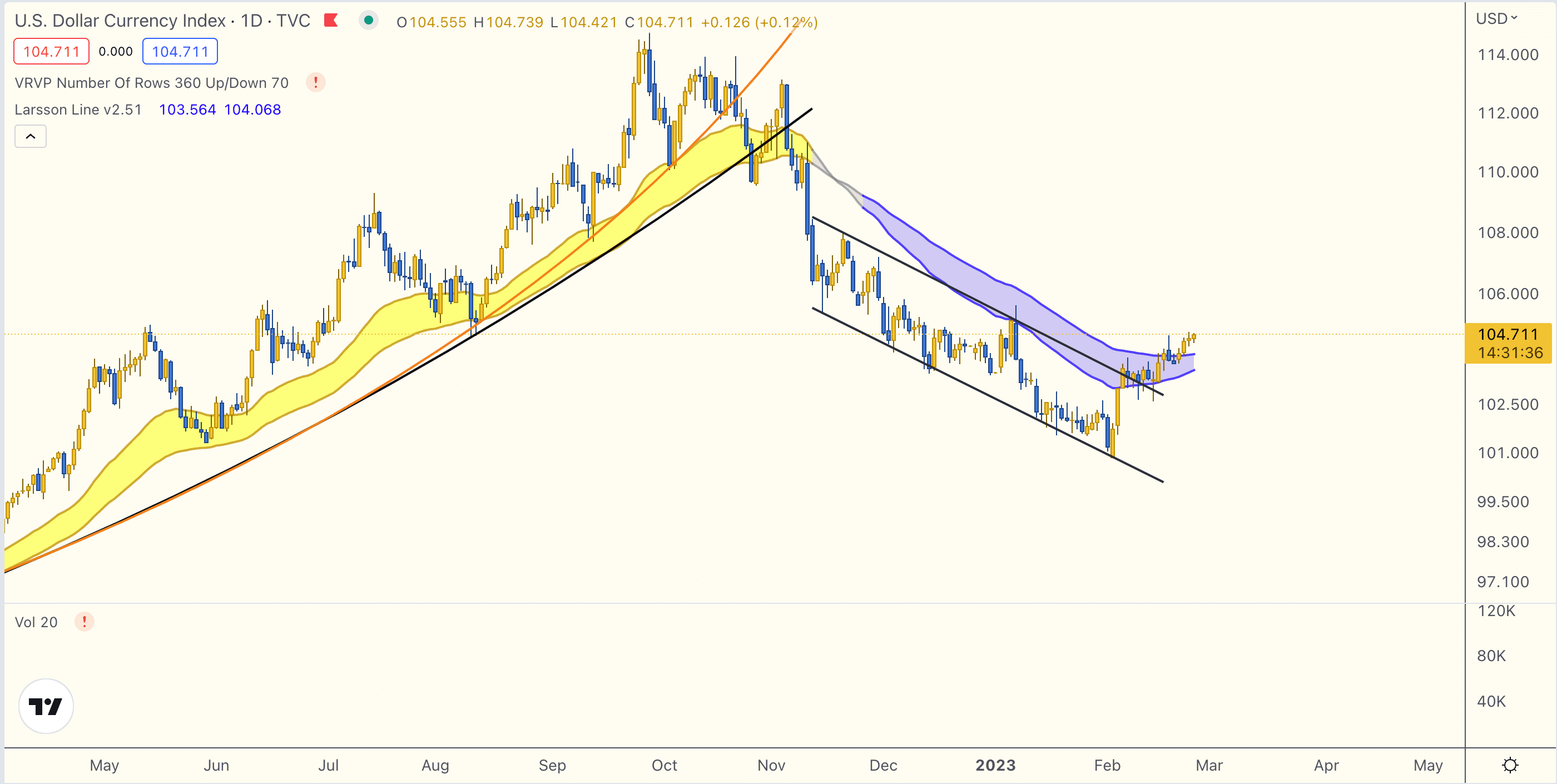

DXY Situation

The DXY situation is for sure holding back a rally right now. This chart has conclusively ended its downward slide in the channel. Who knows where we go from here.

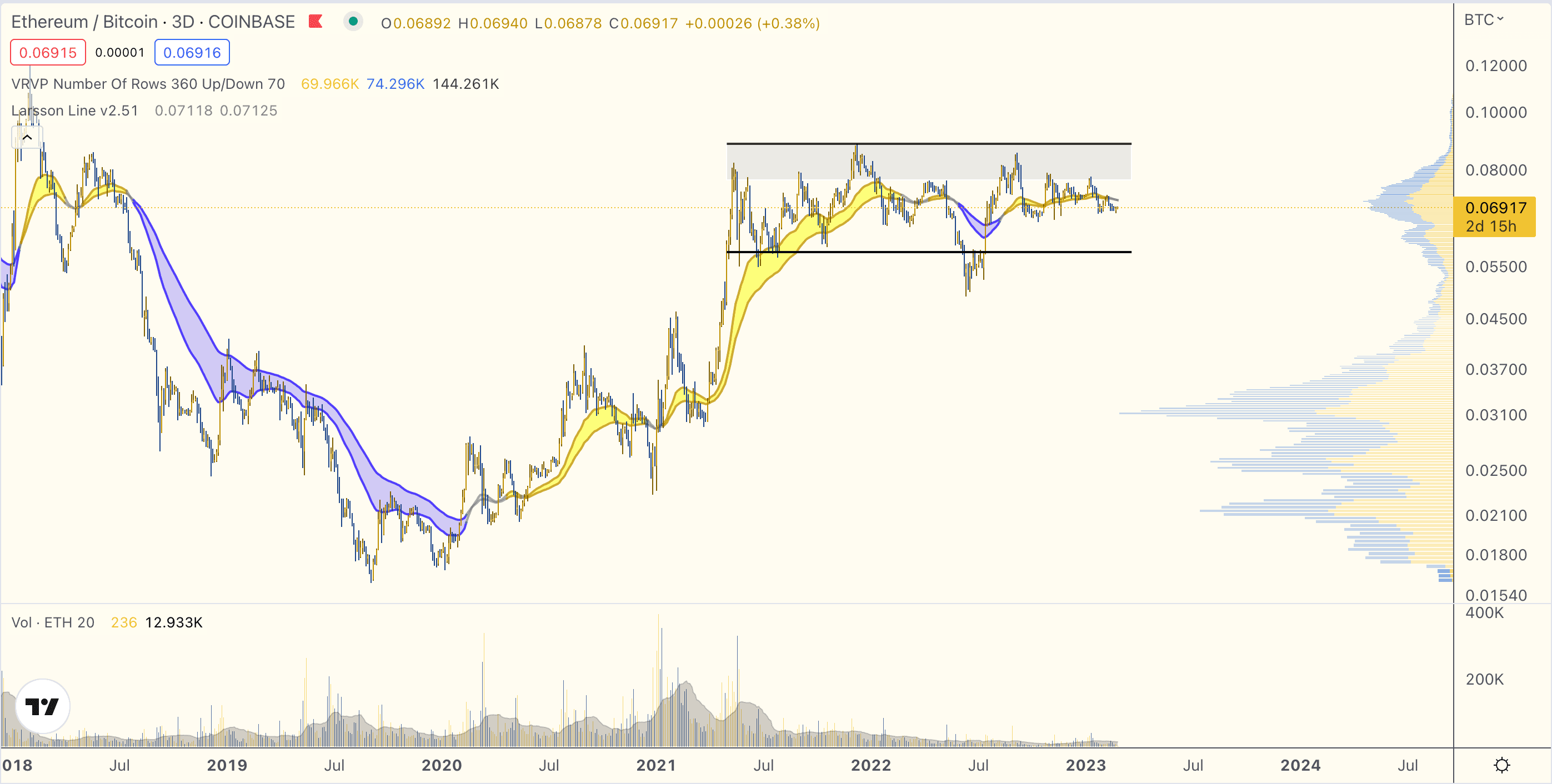

Ethereum

(ETH)

ETH/BTC looks exactly the same as for months: It’s in a consolidation range.

An upside breakout would be huge and could shake up crypto at its core. But that hasn’t happened yet. It has also not broken down. In short: No news.

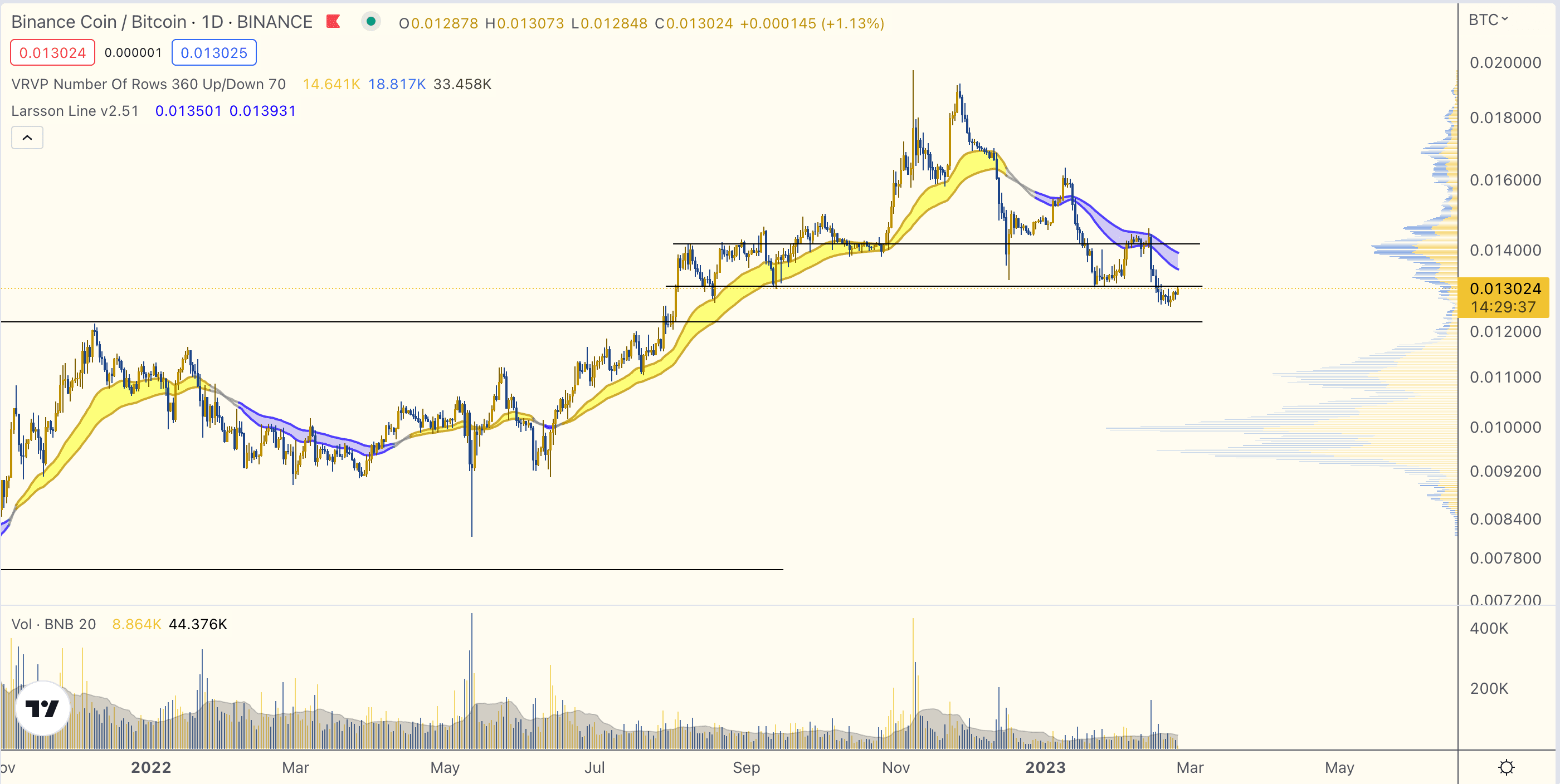

Binance

(BNB)

BNB/BTC continues looking pretty bad.

Caution!

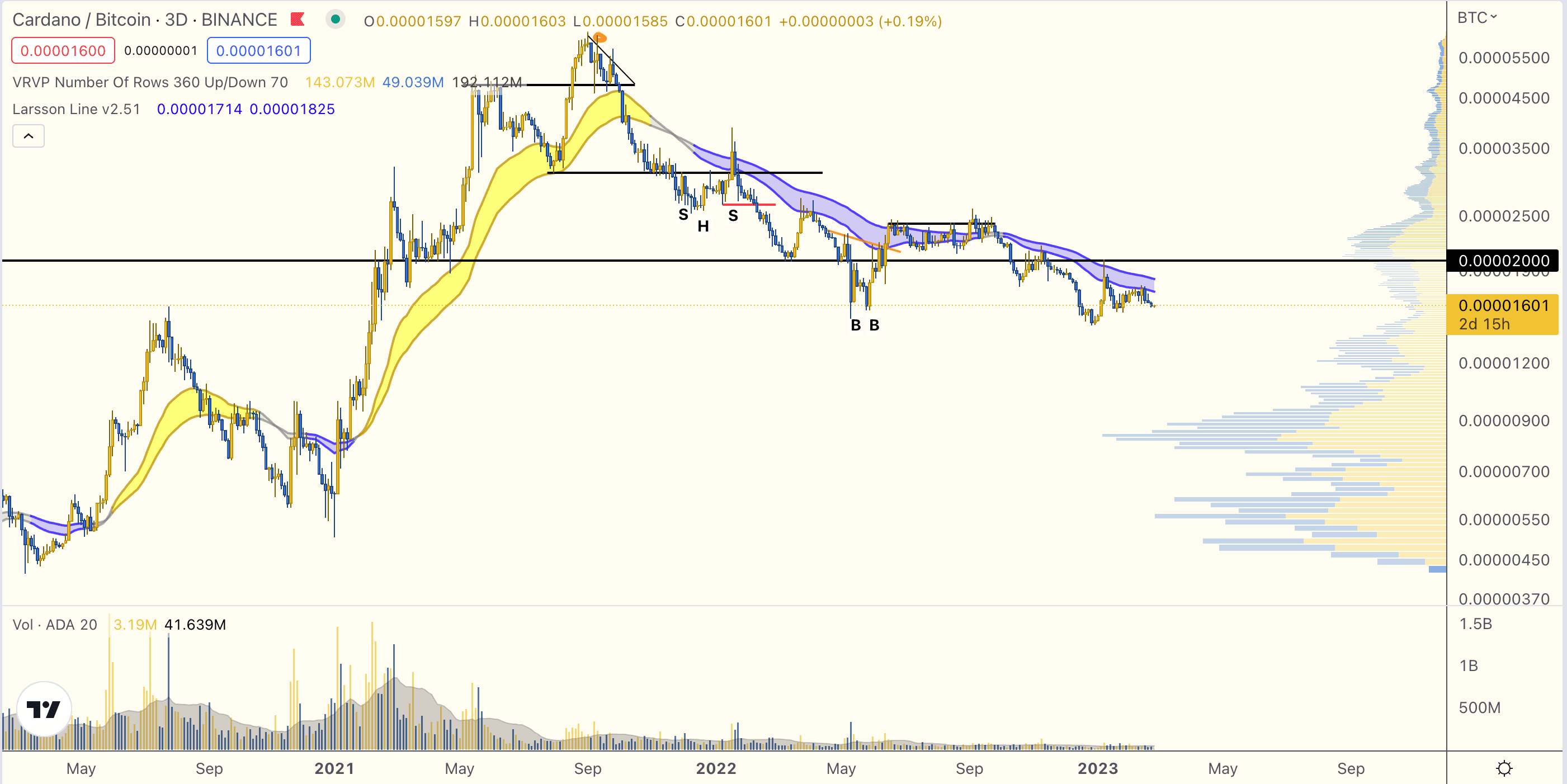

Cardano

(ADA)

ADA remains weak. The trend is down on all timeframes. The attempt to break above the 2 ksats failed.

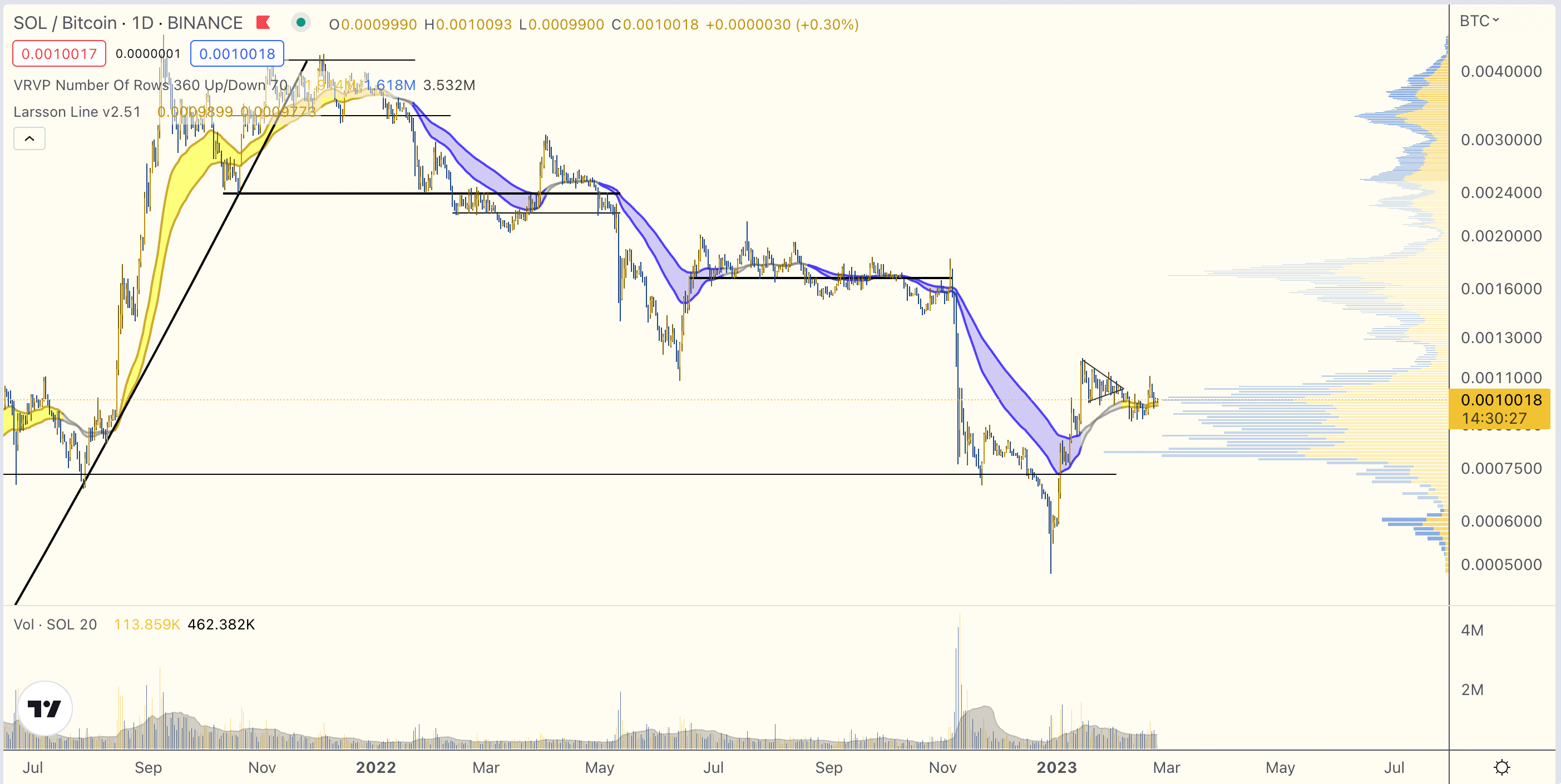

Solana

(SOL)

SOL/BTC found real support and is now consolidating. The bulk of the volume is below current levels. The trend has turned up, on the daily. Would love to find a clean entry period.

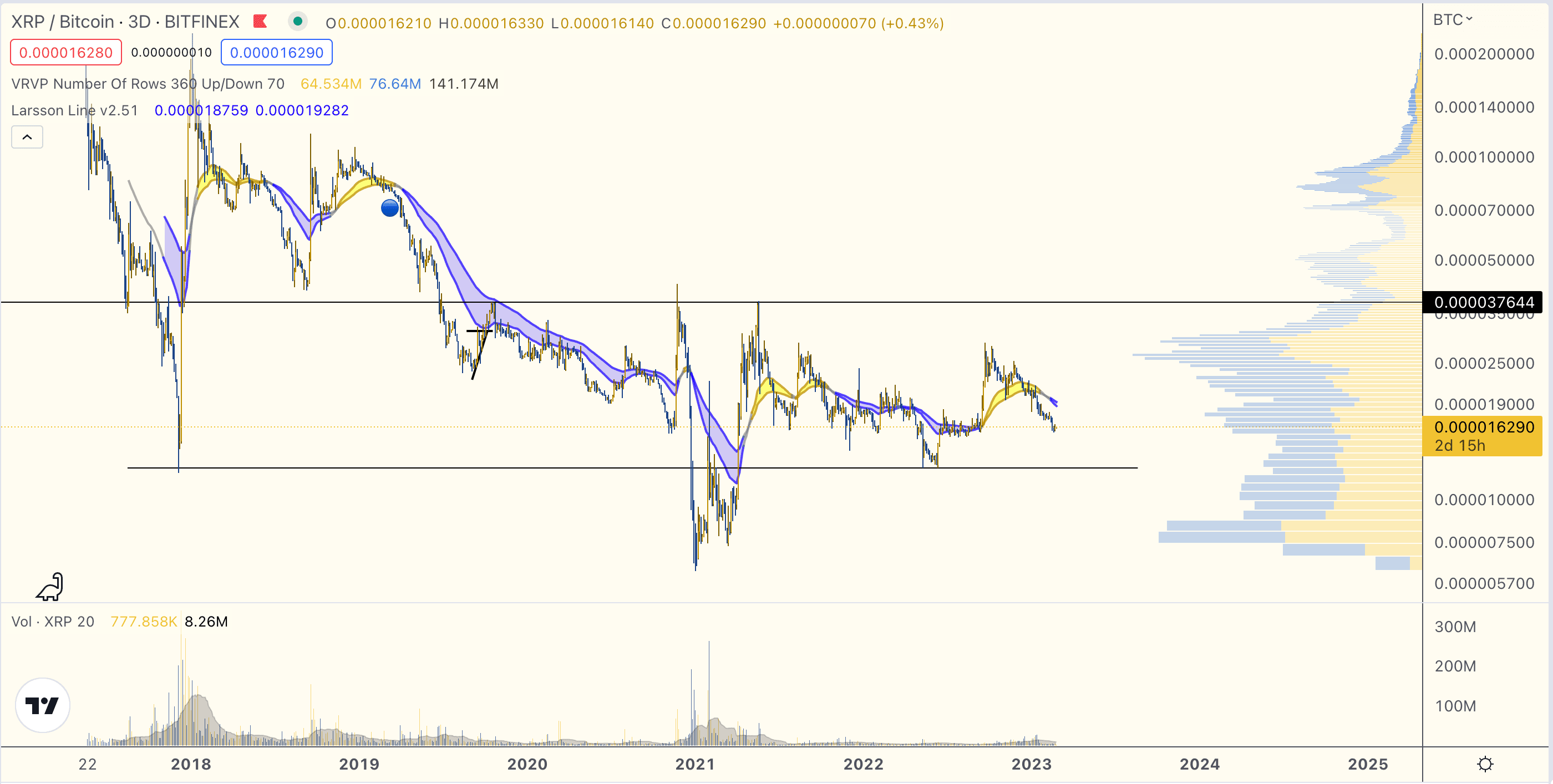

XRP/BTC remains in its wide range. Trend flips inside this range aren’t really actionable, but a solid breakout supported by the trend direction will be.

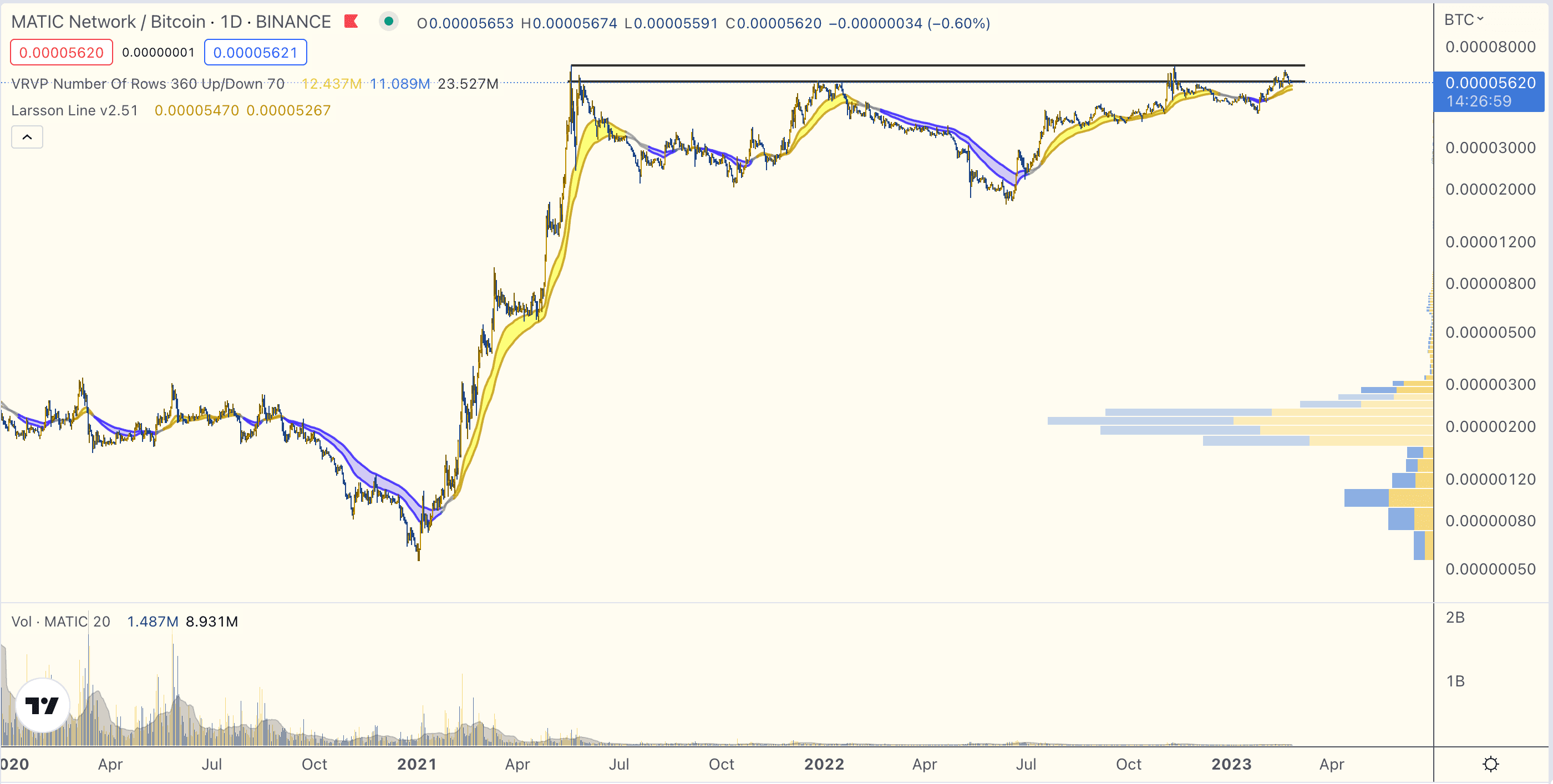

Polygon

(MATIC)

MATIC/BTC continues to push deeper into the resistance zone, nearing a breakout with the trend up both on the 1 day and 3 day candle timeframes.

A breakout could definitely be a setup for a controlled entry if it happens. For now, I’m still waiting.

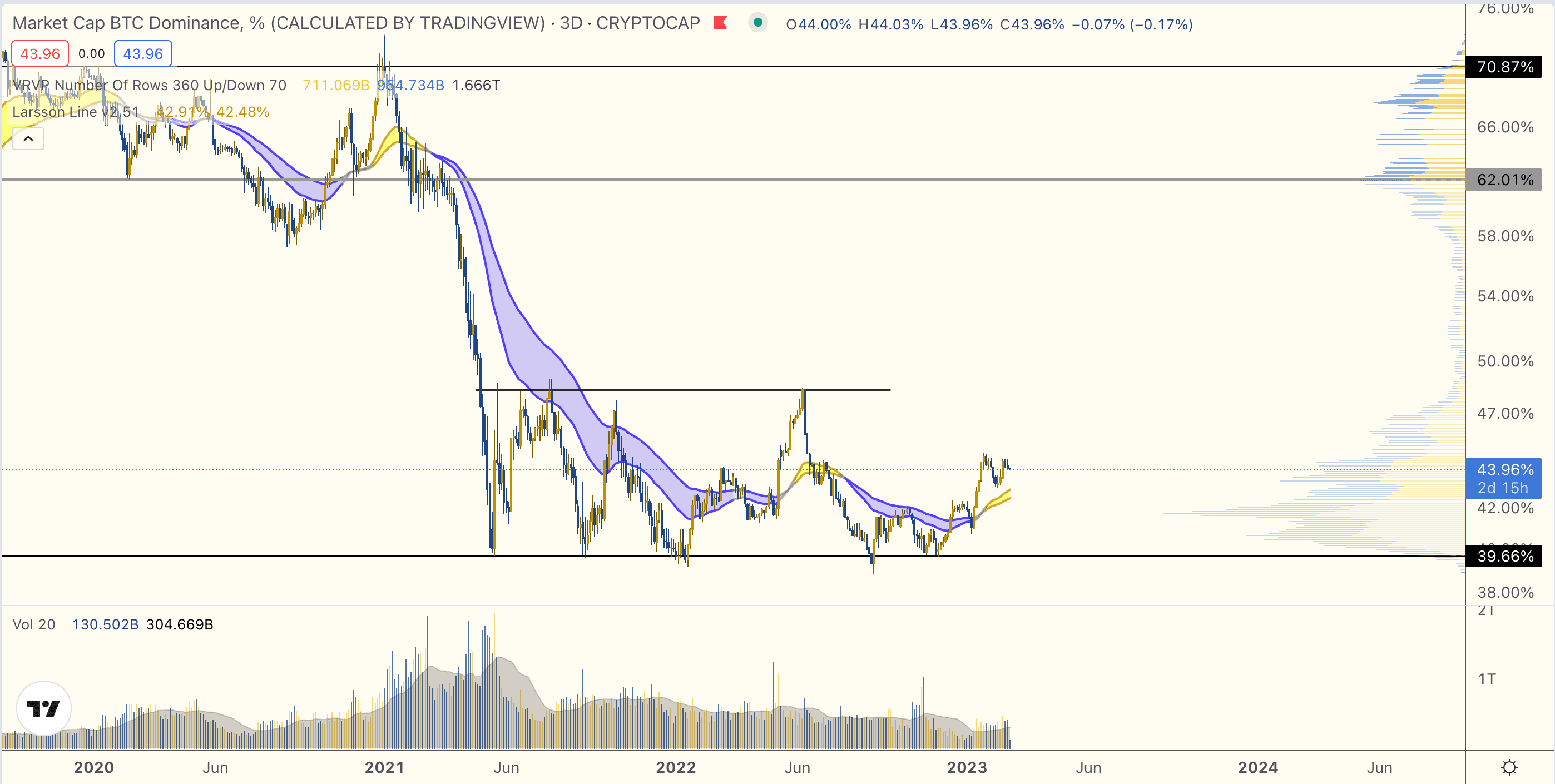

Bitcoin

Dominance

Bitcoin dominance remains uneventful and hesitant. There has not been any real breakout for alts but neither has there been a massive run back to Bitcoin safety. We need more clues.

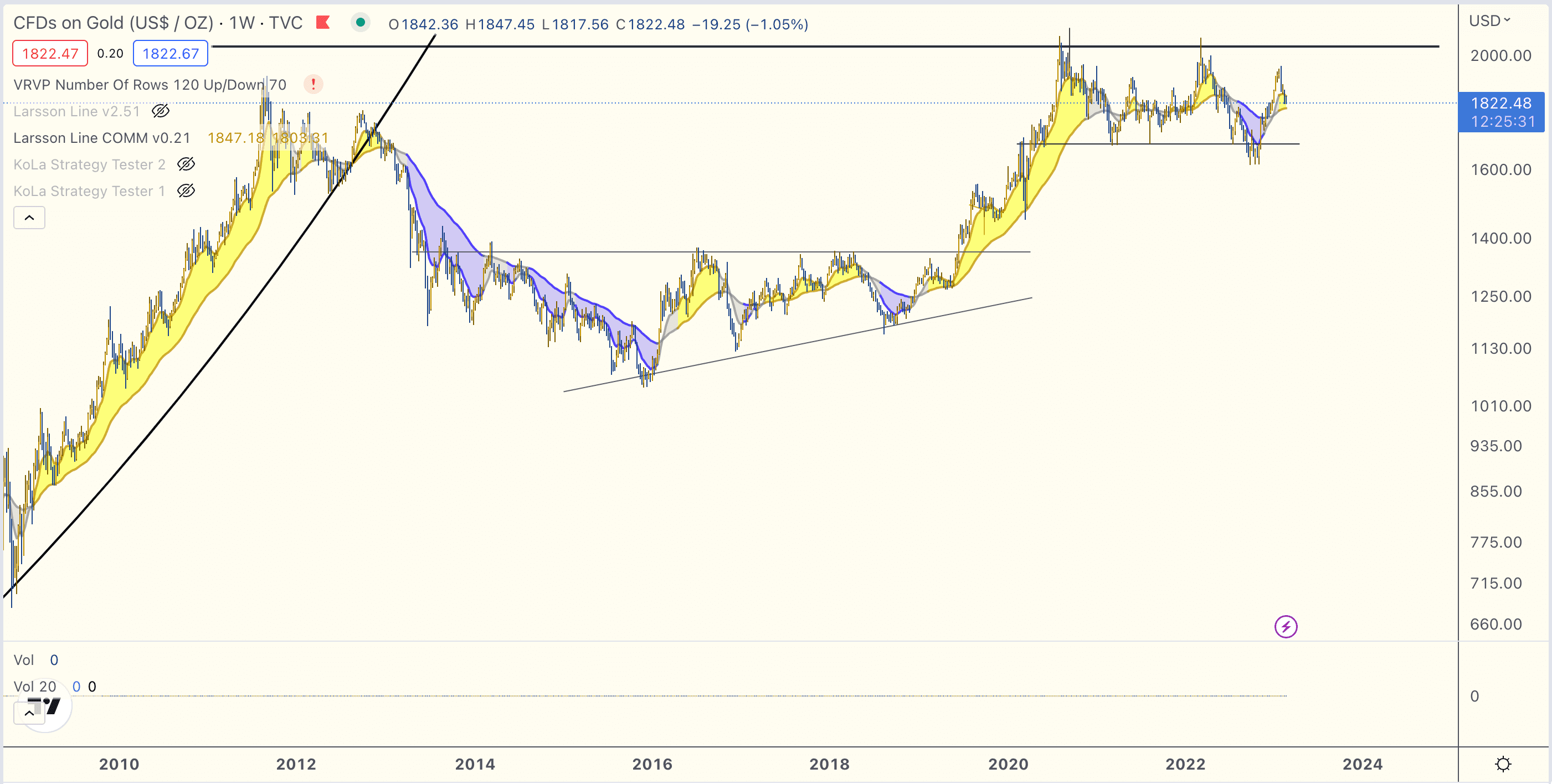

Commodity

Gold

Gold remains in uptrend on the 1 week chart.

The dominating chart construction is a range between 1682 – 2033.

A breakout of this range would confirm a decade-long cup & handle formation.

That would be an insanely great R/R entry with a target in the 3500-4000 zone.

In terms of fundamental demand and supply, gold also looks rather promising. I covered that in a video on Feb 8th, 2023.

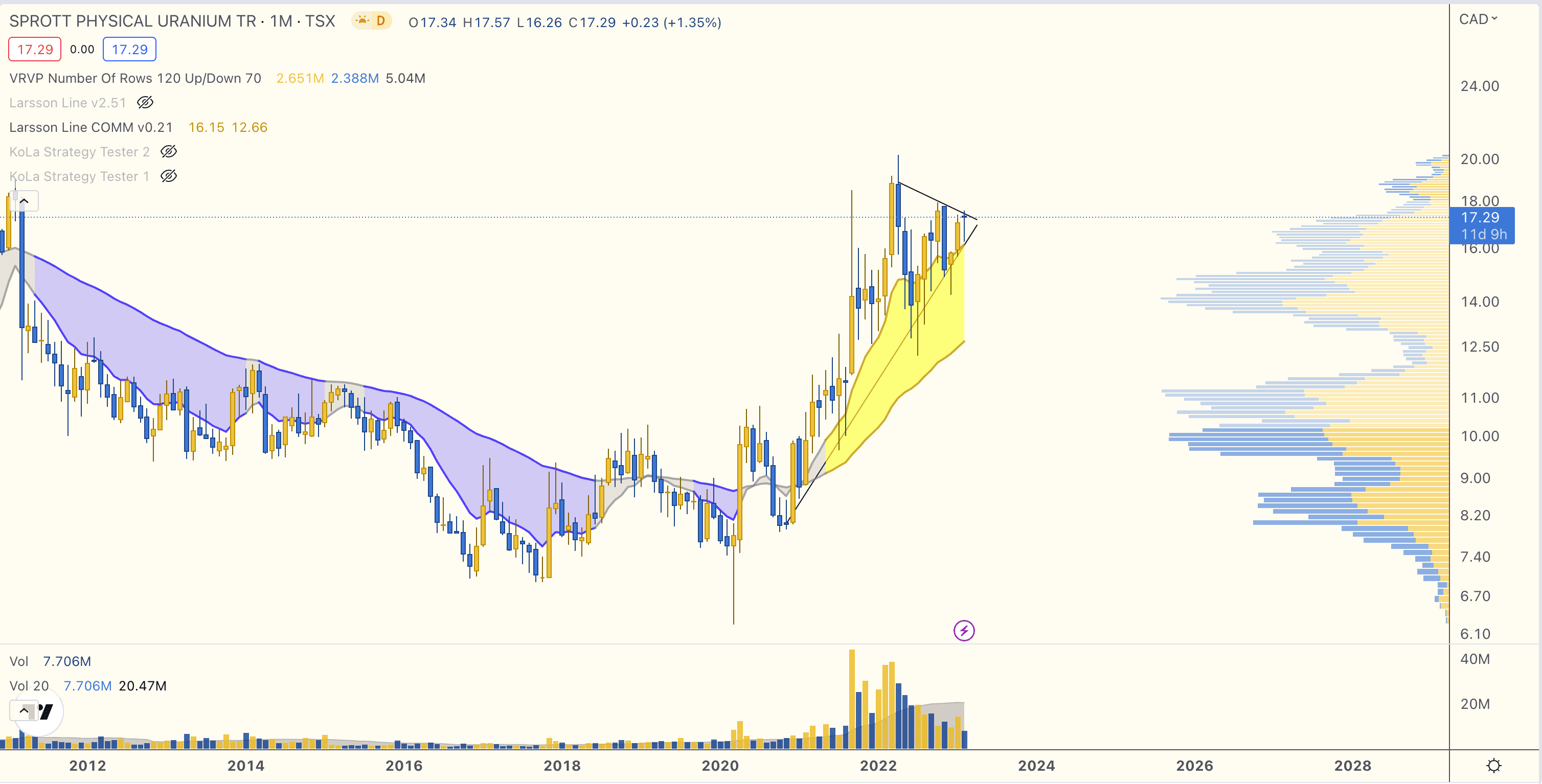

Commodity

Uranium

Uranium remains in uptrend on the 1 month chart.

The chart is painting higher lows.

In terms of fundamental demand and supply, uranium looks very promising. I covered that in a video on Feb 9th, 2023.

We will be interested in getting your feedback on the content of these reports. Please take a few minutes to give us your feedback here.

BTC

Trend is up. Rejected at 25k resistance.

ETH

ETH/BTC is consolidating below resistance.

BNB

BNB/BTC trend is down. Support flipped resistance. Possibly H&S top.

ADA

ADA/BTC trend is down. Rejected at resistance.

SOL

SOL/BTC trend is up. Consolidating.

XRP

XRP/BTC is ranging.

MATIC

MATIC/BTC is very close to range breakout!

BTD.D

Hesitating.

Gold

Trend is up. The chart is ranging. Fundamentals seem positive

Uranium

Trend is up. The chart is making higher lows. Fundamentals seem very positive.

With great respect

Anders Larsson, M.Sc.

[email protected]

@ctoLarsson

@ctoLarsson

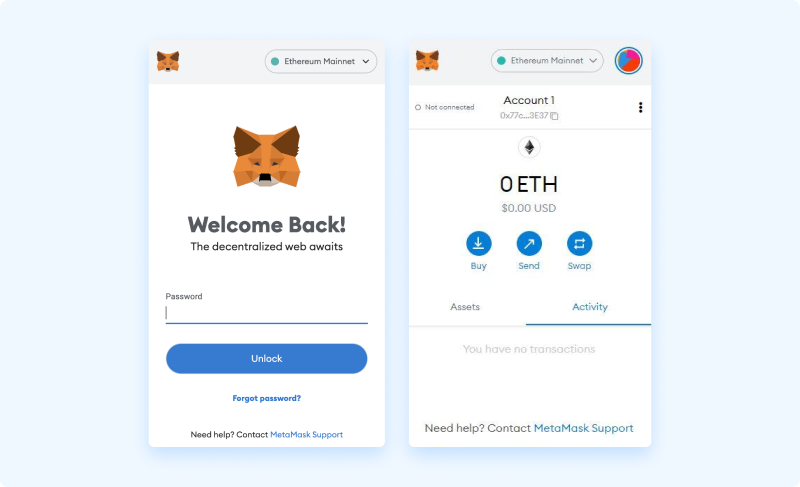

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

Once downloaded and installed, we are presented the option to [Get Started].

Once downloaded and installed, we are presented the option to [Get Started].

Once downloaded and installed, we are presented the option to [Get Started].

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Now that our wallet setup is finished, by default Metamask will connect to the Ethereum Mainnet, as seen in figure 1.0. Metamask can also be configured to use the same keys across other networks. Networks are added via the pull-down menu at the top of the browser extension.

When connecting your wallet to Web3 dapps and sites you expose your public address. This is safe but allows the site to see your transaction history and serves as your on-chain identity when on Ethereum and other EVM-compatible chains.

For a more detailed tutorial for MetaMask please view this Moralis Blog post.

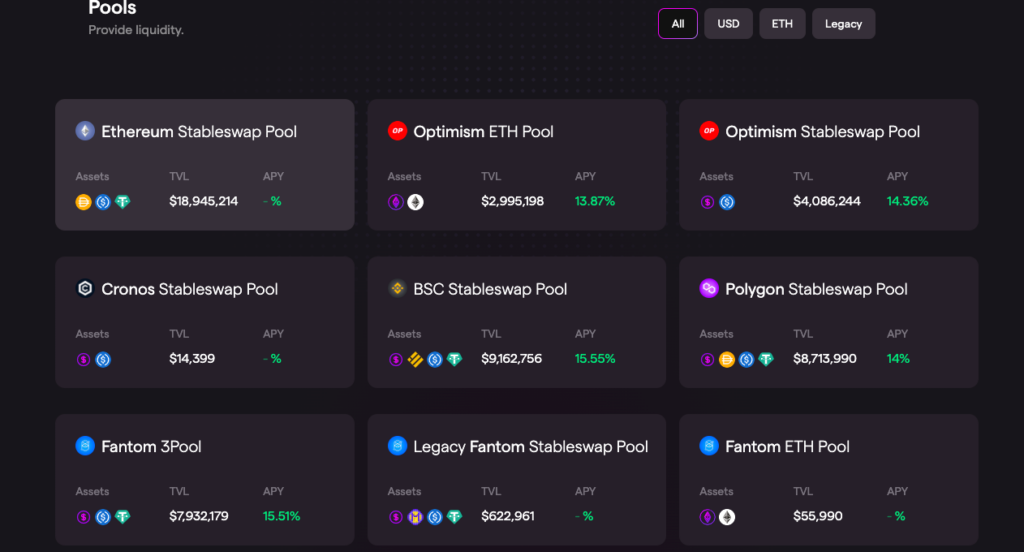

Coinbase recently announced the launch of their EVM-compatible Layer 2(L2) chain. This chain adds to the other many already existing L1 blockchains, L2s, and other sidechains in the crypto ecosystem. As we move closer toward a multichain future, the new challenge will be how to navigate your way across these different chains. In this issue, we will explore how you can win your way in a multichain environment by using 4 different protocols.

The main way to do this is by providing liquidity to any of the top bridge aggregators – like Hop, Synapse, and Across. In return for doing so, you’ll earn a trading fee for your service.

The first major bridge is Hop Protocol. Built on a roll-up token bridge, Hop Exchange allows users to transfer assets cross-chain between major Ethereum Layer 2s and sidechains. The protocol leverages market makers known as Bonders, who earn fees for fueling the liquidity behind these swaps. The bridge currently holds around $66M in value locked and has facilitated billions of dollars in transfers.

After launching the HOP token, the protocol implemented a liquidity mining program, issuing 2.2M HOP monthly on ETH, USDC, DAI, and USDT liquidity pools. The allocation of the tokens is determined by the volume of each bridge, which is changeable by governance. Interestingly, Hop currently offers a few pools with multi-asset rewards.

The first is the SNX bridge which is incentivized with both HOP and OP, offering a 28% annualized yield for LPs. The other two notable pools are the DAI and USDT Gnosis pools, where LPs of these stablecoin pools earn both HOP and GNO as part of their rewards program.

Synapse (SYN) is described as a cross-chain messaging protocol. The Synapse Bridge enables users to swap between a range of L1 and L2 assets using an AMM. Unlike Hop Protocol, Synapse expands beyond Ethereum and its encompassing chains and enables swaps between alternative Layer 1s like Canto, Avalanche, and Harmony, in addition to the prominent Ethereum L2s like Arbitrum and Optimism.

Similarly to Hop, Synapse also features the SYN token, which is distributed via a yield-farming program across most pools. Below you can see a handful of lucrative opportunities, with yields reaching as high as 22% for the hottest new L1 on the market: Canto.

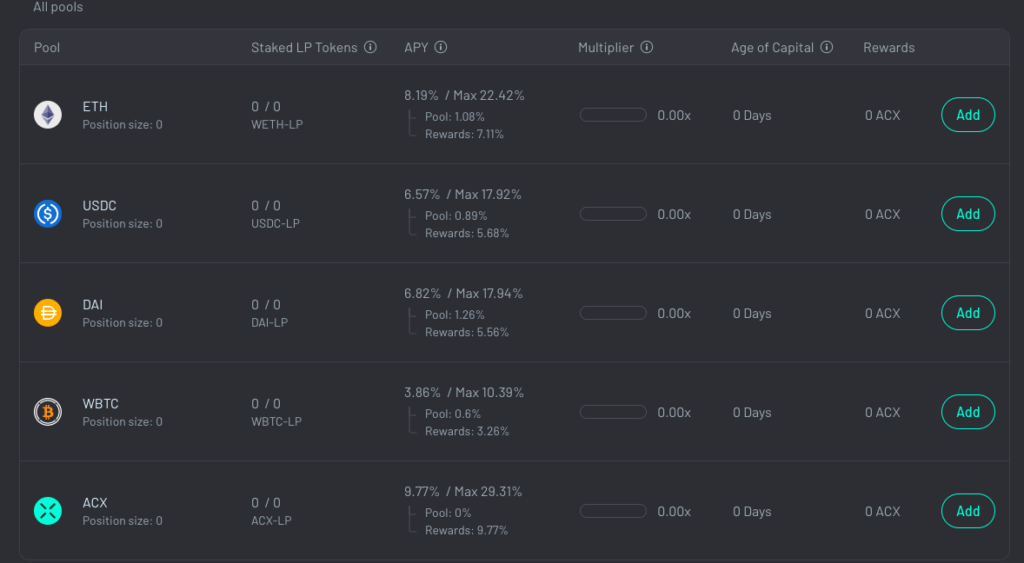

Across Protocol has become a fair competitor on the cross-chain landscape, recently crossing over $1.3B in total value transferred. Built by the team at UMA Protocol, the bridge works by offering incentives for LPs to provide short-term loans to users on the other chain, which are repaid after two hours from a liquidity pool on L1.

After launching the token in November, the protocol now offers yield-farming opportunities for the ACX token. Across’s yield farming program stands out as it gives LPs a rewards multiplier based on the amount of time the user has provided the liquidity. Users can reach the max APY listed below by providing liquidity on the protocol for more than 100 days.

The final bridge we’ll discuss is Stargate, built on Layer 0’s omnichain technology. The protocol currently has $381M in TVL with its token, STG, trading at an $83M market cap and $600M FDV. Similar to the above bridges, the protocol taps into its native token in order to boost the yields for prospective LPs.

Most of the pools on the platform include these STG rewards – going to upwards of 10% APY on the Metis USDT pool and 9.9% APY on the FRAX Optimism Pool.

It is evident that the future of the crypto ecosystem will be multichain as new layer 2 chains launch. As of now, the best way to take advantage of such a crypto environment is by investing in cross-chain protocols.

Every day, people bridge between chains. As a result of this guide, you can start earning right away. The multi-chain future will be won by those who provide liquidity for these value flows. Take a look at the landscape and see if one of these is the right app for you!

We would like to hear your thoughts on the content of these reports. Please take a few minutes to give us your feedback here.

Finding a more specific project, token, or coin is straightforward. Relevant source material for all data is cited. Follow the links to investigate on your own!

Finding a more specific project, token, or coin is straightforward. Relevant source material for all data is cited. Follow the links to investigate on your own!

Decentralization is an ideal more than a state of being. It contains characteristics including self custodianship, trust minimization, public accessibility, permission minimization, and auditability. Decentralization acts on a spectrum of the highest level of decentralization to the absence of some.

Smart contracts are automated processes on a decentralized network. Also, any user can interact with these contracts. When submitting a transaction to the contract, it is final. That means every Uniswap swap, NFT purchase, token transfer, and collateral deposit can not be reversed. Tread with caution; this is a powerful technology.

Abbreviations

This is a list of abbreviations often used in Moralis Research, with links to deeper explanations when available.

| TERM | EXTENSION |

|---|---|

| DeFi | Decentralized Finance |

| TradFi | Traditional Finance |

| CEX | Centralized Exchange |

| DEX | Decentralized Exchange |

| AMM | Automated Market Maker |

| LP | Liquidity Provider |

| TVL | Total Value Locked |

| AUM | Assets Under Management |

| SDK | Software Development Kit |

| EVM | Ethereum Virtual Machine |

| WASM | Web Assembly |

| KYC | Know Your Customer |

| PoS | Proof-of-Stake |

| PoW | Proof-of-Work |

| RPC | Remote Procedure Call |

Glossary

This is a list of glossary terms often used in Moralis Research, with links to further information when available.

| TERM | DEFINITION |

|---|---|

| Derivatives | Financial products that reflect the value of another, including the current price, future price, or price volatility. |

| ERC-20 | The standard for tokens on Ethereum. |

| ERC-721 | The standard for non-fungible tokens on Ethereum. |

| Liquidity | The capital, asset, cash, or securities that are instantly accessible to the market. |

| LP Tokens | Token issued for liquidity providers of AMM, money markets, or other DeFi systems. |

| Native Asset | The asset or coin that underlies a blockchain network. Used for transaction fees and in the consensus model of the network. |

| Oracles | A service or network that provides data from real-world information into a blockchain-accessible form. |

| Slippage | When price moves as a result of a market order that the current liquidity is unable to fulfill. In the case of AMMs, this can result in fewer tokens than originally ordered. |

| Spot | The underlying or physical asset that is available to trade. |

| Synthetic Assets | A crypto-specific derivative that’s represented by a token that tracks the price of an asset with no direct backing. |

| Tendermint | Byzantine fault tolerant consensus standard for blockchain development. |

| Ticker | The term used to describe the trading symbol of a crypto asset. For example, BTC (Bitcoin) or ETH (ether). |

| Token | An asset issued on a blockchain – has a protocol specified or market value. |

People Also Read